Did you know?

ChinaBio® Group is a consulting and advisory firm helping life science companies and investors achieve success in China. ChinaBio works with U.S., European and APAC companies and investors seeking partnerships, acquisitions, novel technologies and funding in China.

Free Newsletter

Have the latest stories on China's life science industry delivered to your inbox daily or weekly - free!

Free Report

Case Study: Cross-border Investing Works for Life Science Angels

Editors’s Note: Greg Scott, our Executive Editor, is also President and co-founder of Life Science Angels, Inc., and served on the board member of N Spine.

Synthes (VRX: SYNT), a leading global medical device company based in Switzerland, has reached an agreement to buy N Spine, a US/Korean company that develops and markets devices to treat lumbar spinal disorders using posterior dynamic stabilization. The acquisition shows that cross-border angel investments can be used successfully to bring a biomedical product to market, ultimately finding a satisfactory exit for investors and founders. Life Science Angels, Inc., was the lead investor in N Spine.

N Spine is a collaboration between a US/Korean businessman, a Korea-based investor/surgeon and American angel funding. Because the product was developed in part and manufactured in Korea, N Spine was able to produce a high quality device at a very low cost.

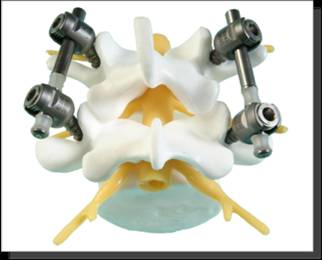

In just two years after receiving its angel financing, N Spine found a buyer in Synthes, a worldwide medical device company based in Switzerland. Synthes makes and markets products for the surgical fixation, correction and regeneration of the human skeleton and its soft tissues. N Spine’s NFlex/NFix II products, which are compatible with pedicle screws made by Synthes, are the only devices on the market for rod/pedicle screw-based dynamic stabilization. In less than one year on the market, they have been implanted in over 400 humans with no device-caused adverse events.

The lead investor backing N Spine was Life Science Angels, Inc. (LSA), a Palo Alto, California group of angel investors. Life Science Angels was founded in 2005 by our Executive Editor, Greg Scott and two prominent Silicon Valley angel investors. So far, LSA has made 19 investments totaling $13 million. These projects have attracted more than $300 million in follow-on venture capital. N Spine is the first liquidity event for Life Science Angels, which notes that in life sciences, the process usually takes much longer than two years between angel investment and exit.

“We’re ecstatic to have our first liquidity event so soon,” said Scott, “and with a valuation that is very favorable for our investors.” The all-cash deal includes a $30 million up-front payment and $45 million in milestone payments. There is also an uncapped earnout which Scott, who served on the board of NSpine, says may double the deal value.

Scott also believes that a similar model will work in China for development of drugs and he is putting his money where his mouth is. “We’re founding ChinaBio™ Therapeutics to in-license promising molecules from the US or China, develop them in China to human proof-of-concept, and then out-license to big pharma or biotech,” he explained. “We expect a 10 to 100 times increase in asset value once we have human efficacy data.” Scott is also the founder of ChinaBio™ Accelerator, a group focused on early stage investment in China.

N Spine's product line includes a dynamic stabilization rod that is compatible with Synthes’ pedicle screws. Synthes says that the two products together are easy to use and surgeon friendly, which should improve their adoption rate in the market. Also, N Spine recently received FDA 510(k) clearance to use their rod designs in lumbar fusion applications and had previously received a CE Mark.

NSpine will remain in San Diego as a separate operating unit of Synthes.

Disclosure: The management of ChinaBio™ Today has an equity investment in N Spine and ChinaBio™ Therapeutics, Inc.

ChinaBio® News

Greg Scott Interviewed at BIO-Europe Spring

How to bring your China assets to China in 8 minutes

"Mr. Bio in China."

Mendelspod Interview

Multinational pharma held to a higher standard in China